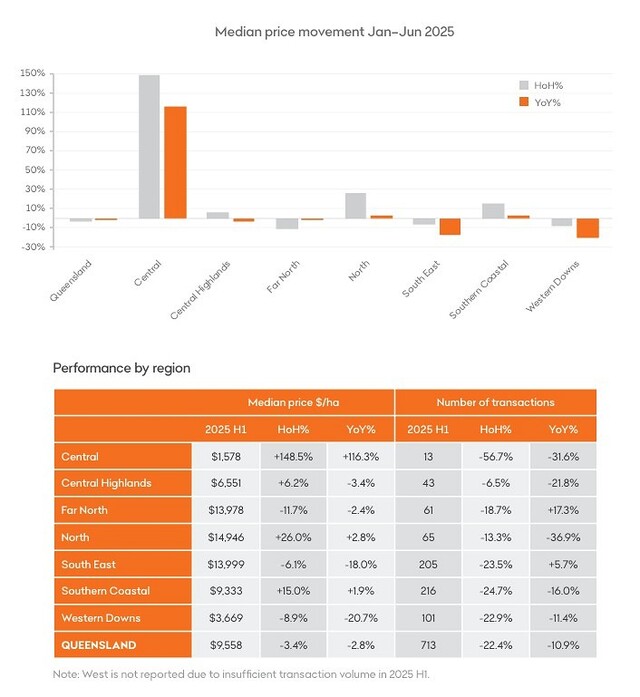

Australian farmland values continued to plateau across the first half of 2025 nationally, but Central Queensland’s median price per hectare rose a whopping 148.5 per cent.

According to the latest report from Bendigo Bank Agribusiness titled 2025 Mid-year Update Australian Farmland Values, Central Queensland’s median price per hectare rose a whopping 148.5 per cent from a mere 13 transactions in the first half of 2025.

Despite the increase, the median price per hectare remains the lowest in Queensland at $1578.

The Central Highlands rose 6.2 per cent for the first half of this year, with 43 transactions recorded, bringing the median price per hectare to $6551.

All regions recorded lower transaction numbers than the last half of 2024 with the exception of the Western region, where nine transactions were made compared to only seven in the back half of last year.

The major drivers of farmland values – commodity prices, varying seasonal conditions and interest rates all played a role in the state-by-state results.

Overall, median price of Queensland farmland fell 3.4 per cent to $9,558/ha in the first half of 2025. This is down 2.8 per cent year-on-year but is still the third highest half-yearly price on record.

The number of transactions was down 10.9 per cent year-on-year, with the 713 transactions recorded the third lowest recorded in more than 30 years.

From a regional perspective, half recorded lifts and half recorded declines.

Keith Dahms, Agribusiness Relationship Manager in Rockhampton commented in the report that there is still appetite for good quality properties in the Central Queensland and the Central Highlands.

“However, high prices are forcing buyers to consider the potential return by taking a longer-term view by considering how a purchase will enhance existing operations, as a transaction may not appear to make sense viewed in isolation,“ Mr Dahms remarked.

“Most are happy to let the market cool and see whether it will flatten out or decline while working to build their own position.“

Transaction numbers were also reasonably split in the state, with 53 per cent in regions that declined and 47 per cent in those that lifted. Two of the top three highest valued regions declined this year (Southeast and Far North) which account for 37 per cent of all transactions and resulting in a fall in median value at a state level.

Positive seasonal conditions and supportive commodity prices mean many farm operations are reasonably well positioned and are not being forced into selling off land.

High land values are also a consideration, with return from output on the land alone unlikely to be profitable. This means buyers are having to be more selective in acquiring property that will benefit their business and to consider purchases as a longer-term investment, rather than looking for immediate return from production.

Demand for farmland remains and with easing interest rates and positive seasonal conditions, there is potential for Queensland farmland to hold steady or even return to mild growth in the next six months.

The national median price of farmland fell to $9,885/ha, representing a minor dip of 3.1 per cent year-on-year. South Australia and New South Wales were the only states to record growth, with a general trend lower in the median price of farmland at a state level.

Australia’s most valuable farmland by region:

Tasmania – Northwest and Northern: $25,143/ha

Victoria – South and West Gippsland: $24,747/ha

South Australia – Adelaide and Fleurieu: $23,651/ha

Western Australia – Southwest: $18,357/ha

New South Wales – North Coast: $14,948/ha

Queensland – North $14,946/ha