As drier conditions “hit home“ Queensland will this financial year experience the country’s biggest fall in total grain and oilseed production.

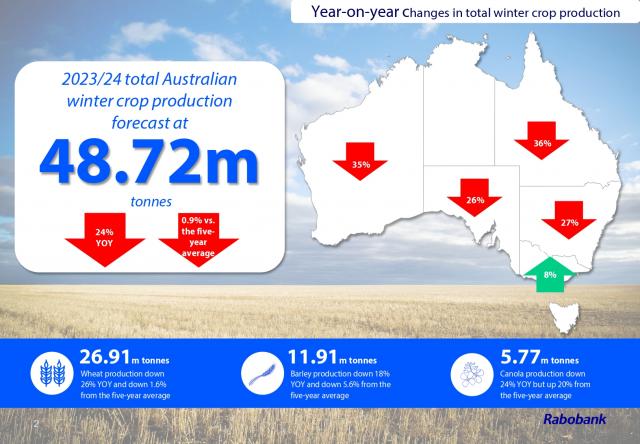

Rabobank’s 2023/24 Australian winter crop forecast predicts production in the Sunshine State to top 2.15 million tonnes, 36 per cent less than last year.

Wheat is expected to see the largest fall – down 41 per cent year-on-year – says report co-author, RaboResearch associate analyst Edward McGeoch, compounded, he said, by reduced plantings this season.

“It does, however, remain above the five-year average.“

Nationally, winter crops are expected to produce 25pc less than in 2022/23.

In all, Rabobank predicts a 48.72 million tonne national crop this year, which is down 24pc on last season’s record-breaking 63.85 million tonnes.

The “more modest“ forecast follows three consecutive years of strong harvests and is just below the five-year average.

Mr McGeoch said prices were expected to provide a silver lining for farmers.

Drier conditions nationally mean less supply and, therefore, higher local prices for wheat and barley.

International demand, meanwhile, is boosting canola prices.

“Production from Canada and the European Union are down, which is driving prices up globally,“ Mr McGeoch told AAP.

Drier weather conditions across many cropping regions, he said, and the prevailing El Nino climate outlook are underpinning the tighter supply outlook.

“Production expectations are varied across regions with some farmers expecting to see elevated production due to positive growing conditions.

“While others will be facing tough decisions as to whether it will be worth harvesting their crop.“

The forecast says all cereal and coarse grain production – including wheat, barley and oats – is expected to decrease this season, with wheat down to 26.9 million tonnes, 26pc less than last season.

Barley and canola, meanwhile, look brighter.

“Barley is expected to see the slightest decline of all grains and oilseeds this year (down 18pc on last year to 11.91 million tonnes),” Mr McGeoch said.

“However, this is primarily due to an increased planted area for barley this season compared with 2022/23, while the remainder of the winter crop varieties saw reductions in planted area.”

Canola production is forecast to fall 24pc on last year to 5.77 million tonnes.

Australian farmers are expected to face a better year ahead when it comes to their farm input costs, the report says, with the exception of diesel.

Report co-author, RaboResearch agricultural analyst Vitor Pistoia says there are two “driving forces” behind the improved outlook for input costs.

“These are lower global prices for many inputs due to a new balance of supply and demand, which is favouring supply,” he said.

“Also, input prices in Australia tend to lag behind the rest of the world, with a long lead time before changes in global input prices are felt locally.“

Input Prices

* Based on market factors at the moment, urea is expected to remain near current levels.

* Phosphate to ease by 10 to 15pc in early 2024.

* For potash, stable prices are forecast.

* Agro-chemicals are likely to have lower prices and better affordability in 2024.

* Diesel prices, however, look to remain at elevated levels, due to capped petroleum production in many exporting nations, along with reduced global refinery capacity.