Positivity about seasonal conditions and commodity prices has boosted confidence among Queensland primary producers in the second quarter of 2023.

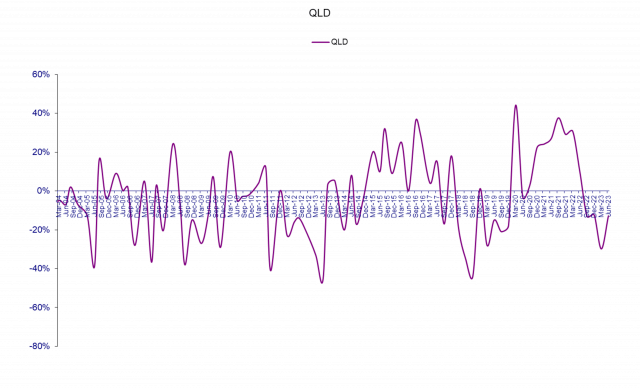

Rabobank’s Rural Confidence Survey found that while farmer confidence remained negative, overall sentiment has improved from 30 per cent last quarter to 13pc.

Also, fewer farmers expect the agricultural economic conditions to drop in the next 12 months, while those expecting business conditions to improve has increased from 10pc to 15pc.

Queensland producers expecting the agricultural economy to decline in the next 12 months are most concerned about the prospect of falling commodity prices.

Dry seasonal conditions, government intervention/ policies and higher interest rates are also worrying producers.

Rabobank regional manager for southern Queensland Brad James said Queensland producers expected a “correction” in cattle prices this year.

“The easing of cattle prices in 2023 will have contributed to suppressing confidence, but cattle prices are still reasonable – countered to some extent by growing input costs,” he said.

Queensland beef producers who expect business conditions to drop in the year ahead has fallen from 40pc last quarter to 33pc in this survey.

More than half (56pc) expect business conditions to remain unchanged.

Softening commodity prices are beef producers’ chief concern, with dry seasonal conditions next.

Mr James said the survey showed confidence improving among the state’s graingrowers, with 89pc now believing economic conditions will stay steady or improve in the year ahead.

“And rain in recent weeks has delivered a full soil moisture profile in many grain growing areas, setting growers up for the

winter crop and for some the forthcoming summer crop,” he said.

For Queensland croppers, dry seasonal conditions, easing commodity prices and rising input costs were big concerns.

“Graingrowers generally enjoyed a good early summer, but the rain did abate for some southern Queensland graingrowing areas earlier this year,” Mr James said.

“However, there have been reports of some outstanding sorghum yields.

“Dryland cotton harvested around St George reflects some outstanding results – up to 14 to15 bales per hectare – while in some parts of the Darling Downs up to 10 or 11 bales/ha.

“The Central Highlands have seen some outstanding yields also, in the range of 17 to 18 bales/ha.”

This survey, completed in May, saw a significant ‘pivot’ in confidence among the state’s cotton growers – with the majority surveyed reporting an expectation that agricultural economic conditions will improve or stay the same in the next 12 months.

This compared with 87pc of Queensland cotton producers believing the agricultural economy would decline in the coming year when last surveyed.

“The recent rain across much of southern Queensland has topped up water storages, setting many cotton growers up,” Mr James said.

He said there was still “undoubtedly“ a desire among producers to invest money back into their existing farming businesses.

“Typically, during these strong economic cycles, we see producers investing in their own farming enterprises through improvements to infrastructure and efficiency advancements,” he said.

Rabobank’s Rural Confidence Survey is a comprehensive monitor of outlook and sentiment in Australian rural industries. It questions about 1000 primary producers across diverse commodities and geographical areas throughout Australia quarterly.

The next results are scheduled for release in September 2023.

Fact File

■ Queensland producer confidence saw a significant lift in the second quarter of

2023.

■ Seasonal conditions and commodity prices are driving the optimistic outlook.

■ More QLD farmers are looking to increase their investment.