The boom in farmland prices across Australia is accelerating into uncharted territory.

Prices paid this year have risen 25 per cent, says agribusiness banking specialist Rabobank in its just-released five-year outlook for farm sales.

And, the scene is set for more land price records to fall during the bumper spring sales.

In Queensland, demand has surged as the median price for grazing land jumped 37pc in 2021 to $2500 per hectare and, for cropping, by 60pc to $8900/ha.

Sales so far this year have shown further price increases.

More than 400 properties were sold, which is only a slight decrease from last year, but sales are substantially bigger.

Prices being paid for Australian cropping land in recent years has outpaced the United States, Canada and Western Europe “but couldn’t keep up with the surge in Brazil and the eastern European Union’s grain export powerhouse, Romania“, the report found.

Grazing land prices have also grown more than North America and Europe.

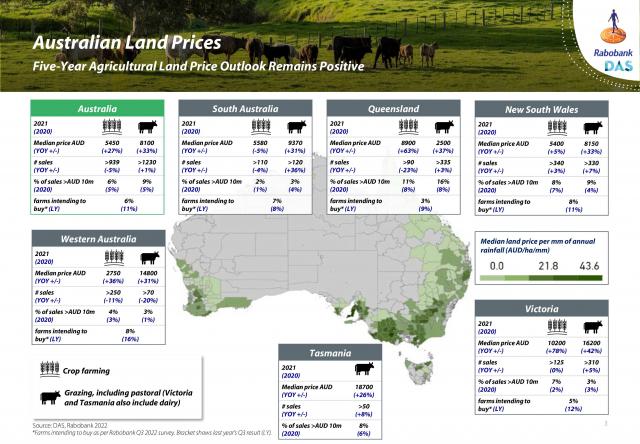

The forecast, which Rabobank research leader, Stefan Vogel prepared, says the new median price paid for arable farmland across Australia is $5400/ha.

Other research shows the national median price of farmland is $7635/ha but Rabobank excluded lifestyle block sales in its analysis.

That median price rose 27pc for grazing, cropping and dairy country in 2021, the research found.

State-by-state analysis unearthed a mix of results.

In Queensland, grazing land prices jumped 37pc in 2021 to $2500/ha and for cropping by 60pc to $8900/ha, with 2022 sales so far showing further price rises.

In Victoria, meanwhile, the price of arable cropping land rose a staggering 78pc to above $10,000/ha.

Even grazing country in the south rose more than 40pc to more than $16,000ha and early results from 2022 sales revealed a further 20pc to 30pc price growth.

According to the Rabobank survey, six per cent of Australian farmers intend to buy land in the next year compared with their forecast of 11pc a year ago.

“Prices of most major commodities reached or approached record highs, widespread rainfall supported production volumes and interest rates were at historic lows,“ Mr Vogel, RaboResearch general manager (Australia and New Zealand) said.

He said the availability of land for sale had tightened and rising input costs – plus interest rate rises – were cooling demand.

“The tide is turning slightly as the land market needs to take a breather after the staggering growth over the past 18 months,“ Mr Vogel said.

But, Rabobank still says the five-year agricultural land outlook remains positive and has forecast a double-digit rise in values this year.

Looking into its crystal ball, the report says climate-adjusted productivity growth remains on the current 20-year trend, with “a potential of one to two years of drier than normal conditions“.

Production volumes are unlikely to stay at the current record levels.

“Our base case forecast is that land price growth will continue, showing double-digit growth also for 2022 as a result of the strong first half of the year,“ the report says.

“However, for the following years, we predict a substantial slowdown of land prices.

“Commodity prices are likely to stay well above the five-year average for the next one to two years, but costs will likely also exceed their five-year average, driven by elevated prices for farm inputs, such as fertilisers, as well as interest rates.“

According to Rabobank, recessions often follow periods of interest rate hikes and land price vulnerability.

Mr Vogel said only a disaster like a drought or the unwanted arrival of foot and mouth disease could take the steam out of the farm sale boom.

And, he said, farm buyers “are not likely to find a cheap gem“ anymore.

“In some cases, fear of missing out is prompting buyers to enter an ’expression of interest’ for a purchase that is much higher than the productive value in order to secure the purchase, not knowing when an opportunity may arise again.

“Buyers have already scoured the pockets of opportunities.

“Competition is fierce and while Australian agricultural investments are still attractive to investors from other regions and abroad, the strong growth of land prices compared to other regions makes some investors also look more intensely elsewhere.“

Rabobank says it expects foreign interest in Australian farming land will remain strong.

“Investors will continue to be attracted to agriculture, not only because of the competitive returns, but also because the returns are often less volatile and not necessarily correlated to the returns of other asset classes.”