The latest quarterly Consumer Price Index (CPI) data, from the Australian Bureau of Statistics, highlights a decreased rate of overall food price inflation, leaving consumers with a positive outlook for the next quarter.

The December 2024 quarter data, released on Wednesday, 29 January, was compared to the December 2023 quarter on the annual rate of food price inflation.

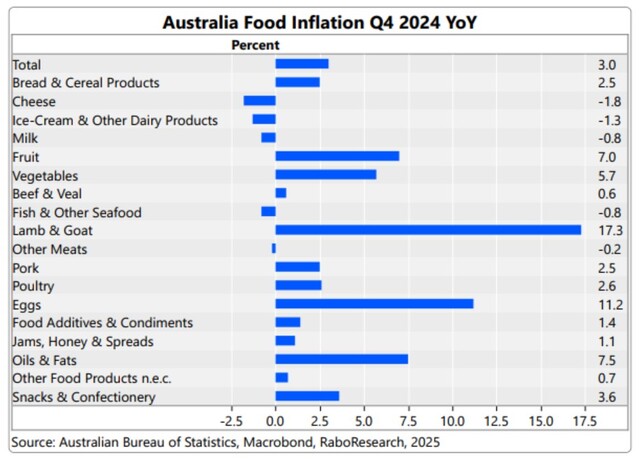

Results showed 3.0 per cent.

This is a decreased rate compared to the year-on-year inflation rate of 3.3 per cent for overall food prices recorded in the September 2024 quarter.

This easing was in line with the trend seen in overall headline inflation in the quarter four 2024 CPI, which annually had fallen to 2.4 per cent (from 2.8 per cent annual inflation recorded in quarter three, 2024).

RaboResearch senior food retail analyst Michael Harvey said this meant consumers had seen the smallest annual rise in food prices in the latest quarter since quarter four in 2021.

However, he said, food costs remain high, with the rate of annual food price inflation still marginally above the 10-year average of 2.7 per cent.

Mr Harvey said the latest quarterly CPI also showed food prices in out-of-home channels – restaurants and takeaway foods – had risen more slowly on an annual basis, coming in at 2.6 per cent in the December quarter, easing from 2.9 per cent in the September quarter.

“Inside the basket, there was deflation seen in some food items – with prices going down in breakfast cereals (albeit up in bread and cakes), the dairy aisle and some meats,” he said.

“An increase in promotional activity across these categories is likely a key driver of these lower prices.”

Mr Harvey said in terms of higher food prices, a spike in lamb prices stood out.

“Lamb prices jumped 17 per cent in quarter four 2024 compared with the same period in 2023, however, this was off a ‘soft comparable’ as lamb prices had slumped annually by 15 per cent in quarter four 2023,” he said.

“For consumers, the prices of eggs and cooking oil continue to be pressure points.

“Eggs rose 11.2 per cent year on year and cooking oils rose a further 7.5 per cent.”

Mr Harvey said it was “no surprise” confectionery prices were also shown to still be rising.

“This has been triggered by high cocoa prices, which rallied in the second half of 2024, with manufacturers passing through the significantly higher cocoa bean prices to customers,” he said.

Mr Harvey said seasonal conditions would be a key watch for their impact on fresh produce prices in the next few months.

Rabobank senior market strategist Ben Picton said in terms of broader inflation, the quarter four result was weaker than the RBA’s forecasts and the expectations of most market economists.

“There was important progress in key categories like rents, insurance costs and new home construction costs,” he said.

“Services inflation remains elevated, but appears to have resumed its downward trajectory.”

Mr Picton said that when taken together with Australia’s recent run of weaker-than-expected economic growth, the soft inflation result should give the RBA confidence to begin easing monetary policy even while unemployment remains low.

“Consequently, RaboResearch today revises its RBA cash rate forecast to incorporate a 25 basis point cut in February and subsequent cuts in May and August to reach a terminal rate of 3.60 per cent,” he said.