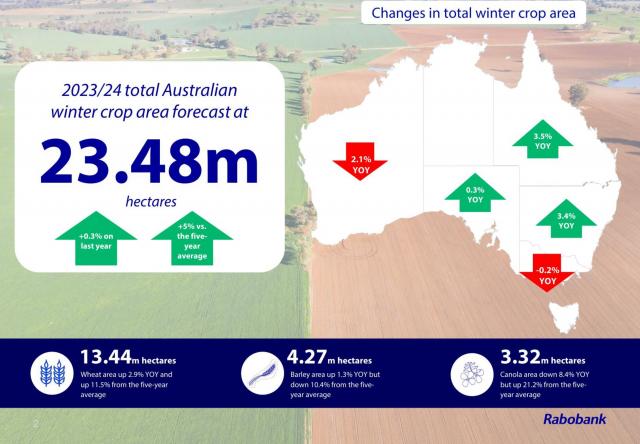

A 23.48 million hectare winter crop is predicted for Australia this year – up slightly on last year – according to Rabobank in its newly-released 2023/24 Australian Winter Crop Outlook.

In Queensland, plantings are expected to increase by 3.5 per cent.

“For several areas across Queensland, early-season rainfall started relatively well, notably in the Fitzroy region, with above-average rainfall totals from January to April contributing to an expected jump in wheat planting,” said report co-author, Rabobank associate analyst Edward McGeoch.

But, while area under crop remains high nationally – projected at about 0.3pc above last year and five per cent above the five-year average – overall harvest totals are forecast to be lower than last season.

Expectations are of drier growing conditions due to the likely transition to an El Nino climate cycle, the specialist agribusiness bank says in its report.

“Australia’s harvest potential for the upcoming season is expected to be below the recent consecutive bumper harvests.“

Mr McGeoch said “on a national level“ the season did not begin as well as in recent years.

Plantings and production

Rabobank’s Australian Winter Crop Outlook forecasts planted area for wheat, barley and pulses to increase this season, but with canola plantings down.

Wheat area is projected to increase 2.9pc on the previous year to 13.44 million hectares (11.5pc above the five-year average) with barley up 1.3pc to 4.27 million hectares (though still down 10.4pc on its five-year average).

Area planted to pulses is also expected to increase on the previous year to 1.77 million hectares (though still down 8.4pc on the five-year average).

Canola planting is forecast to be down 8.4pc on last season to 3.32 million hectares. However, this would still be 21.2pc above the five-year average, Mr McGeoch said.

“Canola plantings have suffered as all other crops have benefited,” he said.

“The trend in most states is that canola planting is down on last year due to the pull back in prices and the drier start to the season, which has seen farmers returning to cereal crops within their rotations.”

Assuming normal seasonal rainfall, Rabobank says, wheat production for 2023/24 could be expected to reach 29.9 million tonnes (down 24pc on the previous year), barley 10.8 million tonnes (down 24pc) and canola 5.4 million tonnes (a drop of 35pc).

However, Mr McGeoch said, with climate models indicating a transition to weak El Nino conditions, “we could see production drop lower, potentially to the lowest total crop in four years (at 41.2 million tonnes)”.

Exports

Export opportunities for the upcoming winter crop remain positive for Australia’s key market in South-East Asia, the report says, with freight charges dropping back to 2020 levels and with Australia’s position as a “favourable origin market”.

Assuming the development of “weak El Nino” in 2023, Rabobank’s base case forecast would have 15.7 million tonnes of wheat from the 2023/24 crop heading to export markets, with continued strong global demand for wheat.

Australia’s exportable barley and canola surpluses from 2023/24 production would be expected to reach 3.3 million tonnes and 3.4 million tonnes respectively.

Market prices

In terms of global grain markets, Rabobank says recent price declines may reflect an only “temporary oversupply of crops in a complacent global market that is assuming nothing goes wrong later in the year”.

“Current global prices may be too complacent, given the political and seasonal risks around the world,” Mr McGeoch said. “In the short term, there is enough grain available on global markets. However, if we look even a little bit further, a myriad of potential issues are bubbling away. The obvious is the Black Sea grain corridor collapsing during Ukraine’s export season, but also Canada is becoming hot and dry, Argentina and the US remain dry and we now see Australia also becoming drier.”

Global wheat prices have collapsed 58pc from record levels seen in March 2022, the report says. However, Australian wheat prices have held up comparatively well, dropping just 20pc in the period, albeit from lower levels.

“Whether the local wheat prices continue to hold up well despite the global price decline depends on the outcome of local production,” Mr McGeoch said. “If Australian wheat production is more favourable than expected, basis could decline to negative levels.”

Locally, Australian Premium White (APW1) wheat track prices are expected to trade, on average nationally, between AUD 340 and AUD 380 over the same period. How strong local prices remain will also be determined by whether drier conditions persist or not, Mr McGeoch said.

The fate of barley prices will partly hinge on the outcome of negotiations to lift Chinese tariffs, the report says. Pending this, for now, the bank forecasts Australian feed barley to continue trading at a heavier-than-average discount to wheat over the next 12 months, on average nationally between AUD 230 and AUD 270 track prices. The high premiums seen last year for malt barley should not be expected in the current season, the report says.

Rabobank forecasts Australian national non-GM (genetically-modified) canola prices to trade, on average, between AUD 560 and AUD 670 over the coming year, with GM canola trading at an AUD 20 to AUD 50 per tonne discount.

Crop inputs

On average, Australian farmers will increase fertiliser application this season, according to the bank’s research. This is the result of a decline in farm input prices after recent spikes, making fertiliser more affordable, Mr McGeoch said, as well as expectations of good returns from farming.

“Urea prices are expected to track around current levels, or with a minor increase, in the coming months,” he said.

Application of urea is projected to be up four per cent on last year, potash up three per cent and phosphate two per cent.

However, this would still be below the long-term average use of these fertilisers by Australian growers, Mr McGeoch said.