Australian farmland prices are set for further growth in the year ahead – but at a slowing pace – Rabobank says in its just-released annual Australian Farmland Price Outlook.

The global agribusiness banking specialist says after three consecutive years of “double digit” growth, the momentum in agricultural land price increases is expected to further slow in 2024, as farm profitability levels come off record highs.

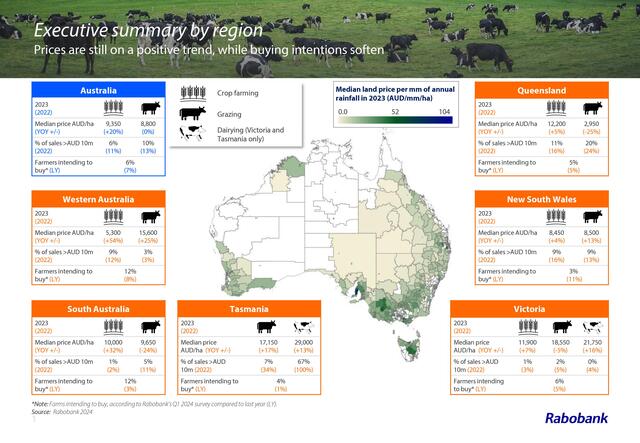

And the price outlook is mixed across sector types and geographical regions, the bank says.

Rabobank is forecasting a “base case” increase of about five per cent in the median price per hectare of all agricultural land types nationally in the year ahead.

“Land prices will maintain their growth trend, but not for all sectors and regions,” the report says.

The bank’s analysis showed while the median price of agricultural land per hectare nationwide grew at a rate of 10.9 per cent in 2023, this was down on the stellar growth rates of 28.6pc and 27pc seen in 2022 and 2023 respectively.

Report author, RaboResearch analyst Vitor Pistoia said this slowing growth trend in agricultural land prices reflected a “maturing land market”, with a less bullish outlook for farm profitability, along with weather challenges and a tighter supply of available properties.

“Australia’s farming sector experienced an unprecedented positive cycle from 2020 to early 2023. Record-high commodity prices and plentiful rainfall supported profitability, which boosted farm business equity and confidence in a brighter future,” he said.

“Outside investors joined this booming sector and turbo-charged competition for land, supported by low interest rates.

“The land market suddenly had many participants bidding – farmers willing to expand, investors pursuing capital gains and companies looking to invest in the carbon credit sector.”

On the flipside, Mr Pistoia said, farmers willing to exit the industry had used the opportunity to sell at rising prices, adding to the supply of land available for the increased demand.

Now, he said, the agricultural land market was finishing this cycle and starting a new one, where the number of farms for sale and bidders is lower and the financial outlook for the sector, while overall strong, is not as positive.

The report says while the outlook for key drivers of agricultural land values – including production volumes, commodity prices and farm income – are still promising for 2024/25, the “upsides are diminishing” compared with recent years.

And interest rates remain an elevated cost, with further increases considered likely and no relief in sight.

“Some regions might see a decline in winter crop production on the back of a dry start of the season,” Mr Pistoia said.

“But the chance of a La Nina in the second half of 2024 offers a potential tailwind for cropping operations. Beef production is poised to expand on the back of good rains in large swathes of northern Australia.

“Commodity prices are still slightly above historical averages for a number of sectors, albeit down from record highs seen in recent years. Improved cattle prices and a better market outlook also mean grazing land should partially recover its price growth pace.”

The longer-term outlook for agricultural land prices – for 2024 to 2029 – indicates a further slowing, the report said, with a gradual reduction in price growth, as buyers seek the “best value for money”.

“The number of deals based on capital gains rather than economic fundamentals may dwindle as the market matures,” Mr Pistoia said.

But the forecast is still optimistic.

“The long-term view is crystal clear – farmland is in demand,” he said, “The pivotal point for the land market now is how to properly evaluate the ‘risk-reward’ scenario for such a long-term investment.”

And while the growth rate in agricultural land prices is slowing, Rabobank does not foresee a drop in land values in its forecast.

“A drop in land values would require widespread drought, serious economic hurdles and/or disease outbreak – none of which is on the horizon fortunately,” the report says.